Superannuation focus: Can gold slice through the inflation and potential stagflation headwinds?

Global Investment Insights

Superannuation focus: Can gold slice through the inflation and potential stagflation headwinds?

April 2023

As inflation continues to bite, the risk of stagflation has not disappeared. As a reaction, gold has been attracting attention from Australian investors due to its historical superior returns during such periods.

The potential bumpy road ahead

Markets may be vulnerable to negative shocks this year, notably stagflation. In 4Q2022, the CPI rose 7.8% y-o-y, the fastest pace in 32 years.1 (Chart 1). As the RBA noted in its February meeting, while inflation rose higher than expected, wage growth continued to pick up – this could in turn put further pressure on inflation. Additionally, the central bank dialled down its growth projection further, to 1.5% over 2023.2 Slower global growth and tighter financial conditions were cited as main concerns.

Chart 1: Australia’s inflation kept soaring while GDP growth is set to weaken*

*Note: 2022 Q4 GDP growth based on Bloomberg’s economists’ median forecast.

Inflation implications

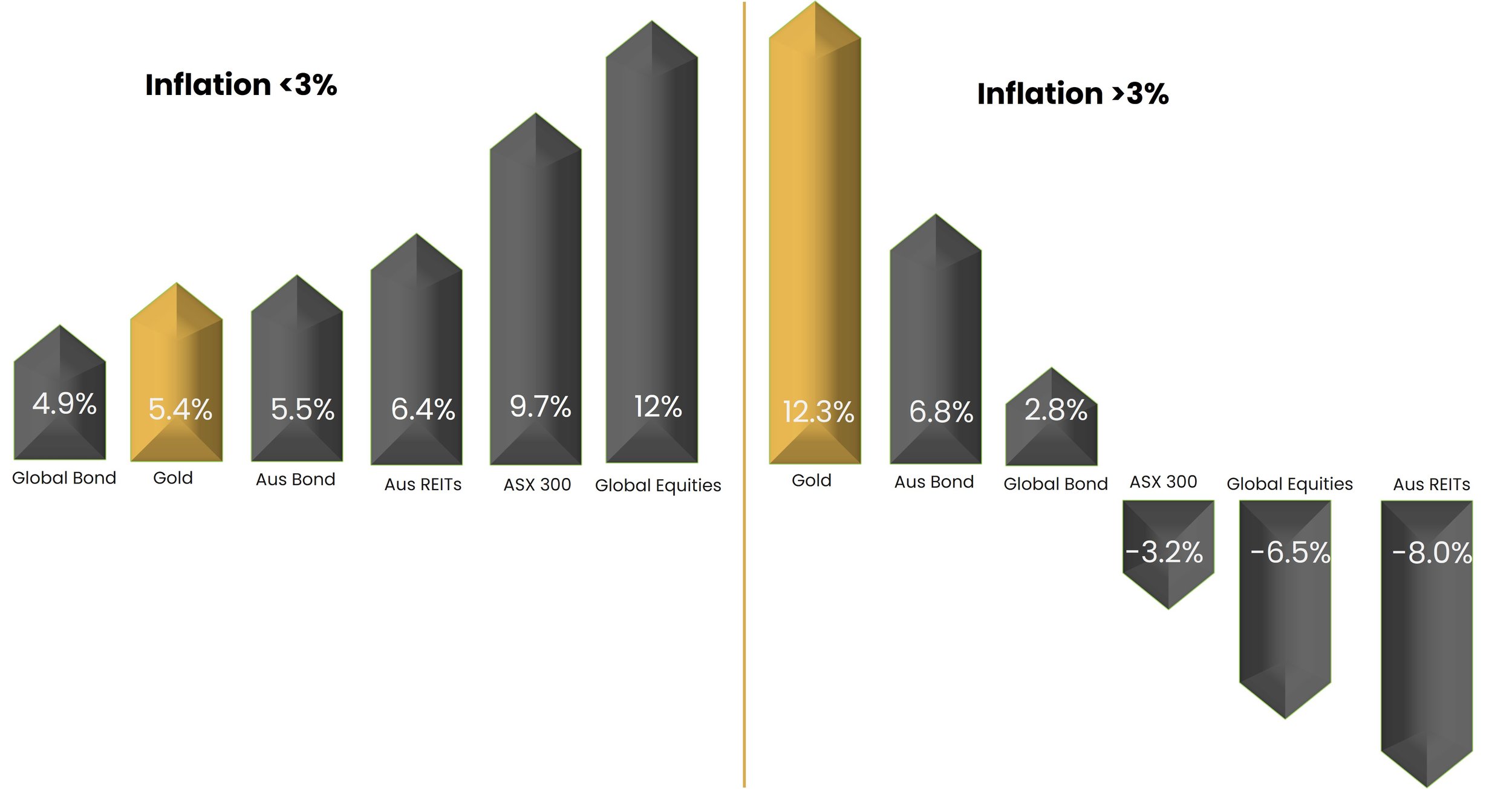

Elevated inflation can, broadly speaking, create issues for investors. The correlation between bonds and equities tends to rise during high-inflationary periods (as evidenced in our investment update). Gold, on the other hand, has long been considered a hedge against inflation, and historical data confirms this (Chart 2). Also, gold’s annualised return of 7.6% in AUD over the past 20 years has outpaced the Australian and world CPIs.3

Chart 2: Gold has historically performed well in periods of high inflation

Major asset returns in AUD as a function of quarterly inflation*

*Based on Australian quarterly CPI, AusBond 0+ Composite Index, Bloomberg Barclay Global Agg, ASX300 Index and MSCI World Index between Q4 1992 and Q4 2022 due to data availability. All calculations in AUD.

Source: Bloomberg, World Gold Council

And should stagflation arise?

It poses significant challenges to superannuation funds’ portfolios as it can severely disrupt financial markets and hamper the performance of major assets. Historical data shows that gold has benefited investors with attractive returns during such periods (Chart 3).

Chart 3: Gold, in AUD, has delivered superior performances during stagflation periods in Australia*

*Data between Q1 1973 and Q4 2022. Part of the indices only date back to 1990s. All calculations in AUD. Based on quarterly data of Australian GDP, CPI, LBMA Gold Price PM, AusBond 0+ Composite Index, Bloomberg Barclay Global Agg, ASX300 Index, MSCI World Index and Bloomberg Commodity Index.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

The 2023 headwinds for superannuation funds are not set to ease up. Against this backdrop, gold may have a significant role to play over the coming year and beyond to help protect portfolio performance and deliver upon member expectations.

GII Disclaimer

The views expressed in this publication are solely those of the individual and do not reflect those of their employer organisation.

All information contained within this publication is general advice only, as the knowledge levels and needs of all individual and corporate investors vary greatly this publication should not be used solely as a decision-making tool, further opinions and information should be sought before making an investment decision. It is the recommendation of Global Investment Institute (GII) that you seek the opinions of a fee-for-service, independent investment adviser before making any investment decision.

The authors, directors or guest writers may have a financial interest as investors, trustees or directors in investments discussed or recommended in this document. It has been assessed by the editors that these financial interests have not had an impact on the material contained here within.

All material appearing in GII’s Global Investment Insights is copyright, reproduction in whole or part is not permitted without written permission from the Publisher, GII.